Pete Stavros, founder of Expanding ESOPs, shared with The ESOP Association a much more detailed public policy proposal with the ultimate aim not to promote ESOPs as we know them today, but to convince Congress to create a new type of qualified retirement plan under the Employee Retirement Income Security Act of 1974 (ERISA) and to call them ESOPs. These plans would only be available to institutional private equity investor funds.

Under this plan, when a private equity firm buys a company, 10% of the equity would be granted to employees, funded by taxpayers via a doubling of its payroll tax deduction, while the firm receives legal immunity pertaining to valuing the price of shares to be bought or sold. The proposal calls this an “Electing C-Corp ESOP,” but it is not an ESOP. It is more accurately a Short Term Equity Plan (STEP). Whenever Expanding ESOPs references this new potential plan, The ESOP Association (TEA) will use the more accurate term: STEP. Below, TEA explains and analyzes how the detailed STEP proposal would implement each Expanding ESOPs principle.

Expanding ESOPs Principle #1:

“Align tax incentives as to be suitable for partial [STEP]s.”

STEP Proposal:

• When a private equity firm buys a company, the firm would establish a STEP into which 10% of the company’s fully diluted common shares would be placed.

• The initial value of this pool would be zero. It would only accrue value based on the level of tax savings that the private equity firm receives through a doubling of its payroll tax deduction.

• The tax benefits the investor receives are limited only by time and profit - 5 years, with carryover – and could therefore substantially exceed any investor dilution resulting from the initial grant. This benefit would be applied after all other tax benefits the firm would be eligible for have been applied and would carry over in the event the firm did not produce enough profits in any given year to make full use. This carryover would likely transfer to a new buyer in a sale.

• The investor would also become eligible for a lucrative new 1042 tax deferral under some conditions.

TEA Analysis:

It is true that as Congress reduced corporate and capital gains taxes over the last three decades, the existing tax incentives encouraging partial ESOP formation have lost a lot of their punch. This newsletter covers this issue in depth on page 19. TEA agrees with Expanding ESOPs that Congress should explore ways to restore the initial value of these eroded tax benefits to better incentivize partial ESOP creation. However, the contemplated tax incentives are grossly disproportionate and appear to be designed more as a tax avoidance system for institutional investment funds rather than a simple incentive system for an employee equity bonus plan. Further, there is no reason to exempt trustees from their fiduciary duties under ERISA to better align the tax incentives.

Another key differentiator is that the STEP proposal avoids using future earnings from the employee-owned portion of the firm to finance the employees’ equity. This transaction is key to employee ownership. Instead, the STEP proposal uses taxpayer funding in the form of dollar-for-dollar tax deductions to pay the investor. It is functionally a redistributive tax policy – taxpayers buy the full value of the employee stake while all the profits of the firm continue to benefit the investors. This arrangement would create a massive boost to free cash flows, all at the disposal and use of the investor.

Finally, existing tax codes incentivize C-corps to sell at least 30% of their equity to their employees. This meaningful share of ownership is a major contributing catalyst for the ESOP culture of empowering employees, improving business success and contributing to local communities.1 There is no evidence to suggest that a 10% equity stake in a company would contribute these same benefits.

Expanding ESOPs Principle #2: “Offer safe-harbor guidelines in situations where there’s a market-based valuation-check to ensure that workers in new [STEP]s are treated fairly and to avoid undue litigation risk.”

STEP Proposal:

• STEPs would be immune from United States Department of Labor and employee litigation.

TEA Analysis:

It is not an unreasonable principle to want clear guidance in cases of genuine arms-length acquisition transactions involving substantial third-party investment. However, blanket immunity from trustee oversight of decisions that materially affect share value, or the price to be paid for the employee shares before or at firm liquidation, leaves employees naked without any protection. Remember, there are limitless ways the investors can protect themselves, particularly with the decision-making authority they hold and the massive free-cash flow that would be generated by the desired tax benefits. Private equity firms have demonstrated extreme talent at returning high value to themselves, even while driving a company into bankruptcy, or breaking it apart to sell off the pieces. Imagine if a STEP plan had been in place at Red Lobster or Toys R’ Us when the private equity funds made decisions that drove those companies into bankruptcy, and then sold off their parts. This type of general immunity would obviate any authority or responsibility of the trustee to protect the employee interest in transactions. The term “safe harbor” is contrary to an ESOP fiduciary’s responsibility to employees. The answer to “undue litigation risk” is not to protect a specific type of transaction, it is to provide clear guidance for all transactions, including those where there is a true arm’s length transaction with a third party. TEA has worked for decades to secure an adequate consideration rule that protects all ESOPs, employees and fiduciaries. TEA is on the cusp of achieving that goal and will continue to vigorously advocate for it moving forward.

Expanding ESOP Principle #3: “Give disproportionate [STEP] benefits to front-line workers (as opposed to highly-compensated executives).”

STEP Proposal:

• The proposal creates TWO pools of equity, both 10% of the company’s initial shares – one for top executives and one for all the remaining employees who make no more

than $150,000 per year.

TEA Analysis:

The STEP plan doesn’t really follow its own principle here because the 10% equity for front-line employees is matched with an equal amount of equity set aside for highly compensated employees in a different account. It is a bit disingenuous to say all the benefits go to “front-line” workers, when the top earners are given their own, equal, account that gets divided among a much smaller pool of employees.

Functionally, all this does is create an equity compensation plan for average workers that runs in parallel to the equity plan created for top executives. The equity plan for executives has full value on day one. The equity plan for employees has zero value on day one and only gains value as the tax deductions for the investment firm

pile up.

Expanding ESOP Principle #4: “Protect the spirit of the ESOP by assuring workers receive meaningful value in situations where companies utilize tax incentives.”

STEP Proposal:

• The proposal is missing many essential elements of what it means under current law to qualify as an ESOP.

• The “spirit of the ESOP” is not “meaningful” value; it is fair market value as determined in good faith by the trustee.

TEA Analysis:

There would be no need to protect the “spirit of the ESOP” if the plan were an actual ESOP. Imagine for a moment, if ESOP employee owners were told upon retirement that the company would provide them with a “meaningful value” for their shares rather than the actual fair market value of those shares. ESOPs are legally defined and must meet the standards

for qualified retirement plans under ERISA to be eligible for the associated tax benefits designed to incentivize them:

• Vesting schedules that, when met, create irrevocable and known rights to ownership

• Transparent ownership allocation system

• Annual ownership valuation that must be defended by the trustee

• Required payout when leaving the company at any time, for any reason, but with penalty unless rolled into another retirement account

• Individual Capital Accounts (ICAs) where shares accumulate and appreciate, and new allocations are made

• Requirement that the trustee must ensure that fair market value is being paid for shares bought OR sold

• Trustee with governance authority (can overrule management) and a fiduciary duty of loyalty and prudence to the plan beneficiaries

These crucial protections provide the public policy substructure that enables the public good that flows from ESOPs as demonstrated by careful research over 50 years of experience. ESOP companies empower and invest in workers by training them and involving them in company decisions at much higher rates than businesses with traditional ownership structures. ESOPs not only increase worker satisfaction; they reduce wage and wealth inequality as well.

Employee-owned businesses experience higher productivity, lower turnover, and greater long-term sustainability. Studies show that ESOP-owned companies are more resilient in economic downturns and provide their employees with significantly higher retirement savings than their non-employee-owned counterparts. ESOPs keep businesses rooted in their communities and prevent job loss due to business closures or out-of-state acquisitions. There is no evidence that Expanding ESOPs’ plan would provide these same advantages.

The STEP proposal provides no mechanism, oversight, or contract to enforce this principle. STEP employees get nothing if the following situations occur:

• The private equity firm fires the employee for any reason

• The employee retires before the private equity firm sells the company

• The employee dies before the private equity firm sells the company

• The private equity firm fails to meet its pre-determined profit targets

The most likely scenario is that employees only get the bonus if they remain employed on the date the investors exit the company and have achieved their financial goals. That is not the “spirit of the ESOP.”

Expanding ESOPs Principle #5: “Provide the [STEP] at no cost to the employees and ensure that the [STEP] is not the sole retirement plan for workers.”

STEP Proposal:

• Employers must offer a 401(k) plan with a 50% match up to 6% of an employee’s annual compensation.

TEA Analysis:

TEA applauds Expanding ESOPs for including this provision. 401(k) plans are a valuable tool to diversify retirement portfolios. That’s why 75% of ESOPs also provide 401(k) plans!

But, this seems to be a hedge (acknowledgement?) that

the STEP plan may very well produce zero value for the

employees. It begs the question: if there is zero value for the

employees at the end of the investment, should the PE firm

be required to pay back all the tax breaks?

Expanding ESOPs Principle #6: “Allow workers to access a portion of their [STEP] value before retirement without penalty.”

STEP Proposal:

With approval from the company’s board of directors, employees can sell up to 20% of its vested shares to the company annually with no excise tax.

TEA Analysis:

This principle and its explanation in the STEP proposal exemplify a stark difference between ESOPs and STEPs: STEPs are a bonus; ESOPs are a qualified retirement plan.

The public policy goal of ESOPs is to improve retirement income security for plan participants. Full stop. The only reason it is in the public interest to provide tax incentives for qualified retirement plans such as ESOPs, 401K plans, 457b plans, and other qualified plans is because they build retirement savings.

If every employee can sell back 20% of their “shares” each year, without penalty, the plan is functionally converted into an annual bonus. Management could announce a “buy back” each year, set a price, and wait for the employees to come streaming in. Because there is no tax penalty for early withdrawal from the retirement plan, our view is that the vast majority of employees would simply take the cash as an annual supplement to their income. Furthermore, because Expanding ESOPs' STEP plan caps each employee at no more than $75,000 in equity allocation, it is likely each employee will be able to sell all shares within even a short hold period for the company by the investment fund. Management would desire, even encourage, these buybacks, because it would immediately increase the underlying value of the other 90% of shares they already own. It would also be completely corrosive to, and prevent, any ownership culture as the employees routinely divest themselves of any company interest.

Every existing retirement plan, including ESOPs, has tax incentives to encourage workers to save until retirement age because Congress recognizes the societal benefit of retirees having financial security. Retirement is when the most significant ESOP benefits affect employee owners. Employee owners 60-64 years old, have 10 times greater wealth than their non-employee owner peers on average. That is the life-changing impact of true employee ownership when they need it most. Allowing workers to sell their equity shares every year with no excise tax is likely to eliminate this benefit. Instead of building for retirement, workers are incentivized to sell their shares annually as a bonus to buy a car, pay down debt, or spend it on any other typical expense. These expenses may be important at the moment, but they are not retirement security.

Expanding ESOP Principle #7:

“Maintain the current structure and benefits that have been highly effective for existing ESOPs (particularly 100% ESOPs).”

STEP Proposal:

• The proposal offers no changes to existing ESOP laws.

TEA Analysis:

This is supposedly the “do no harm” principle.

It is true that the STEP proposal creates an entirely new kind of plan that is distinct from ESOPs. Yet, by labeling these new creations ESOPs, the proponents are inherently violating this principle by placing existing plans at tremendous risk due to the massive new tax expenditure that would be lumped together with existing ESOP plans.

However, the proposal ignores the enormous market distortion that this plan would create. Why should Congress reserve the immense tax incentives and legal immunity described above only for private equity? If an individual or company buys a C-Corp business and wanted to install a STEP plan, they would be denied and be ineligible for any of the lucrative tax benefits. With incentives this lucrative, nearly every deal that the 19,000 private equity firms close could incorporate it. The STEP proposal would not change existing ESOPs; it would eclipse them.

Closing

TEA agrees with some of the issues Expanding ESOPs highlights in its principles. However, the detailed STEP policy proposal is the wrong solution if the true goal is employee ownership and building retirement wealth for employee owners. Fortunately, nothing in federal law prevents private equity firms from providing their employees with equity in their companies. Many firms already share equity with employees without any new subsidies or changes in federal law. TEA enthusiastically encourages them to keep doing this important work. What TEA cannot support is rebranding STEPs as “ESOPs”, advocating for billions in new tax breaks, and securing special legal immunity.

STEPs ≠ ESOPs

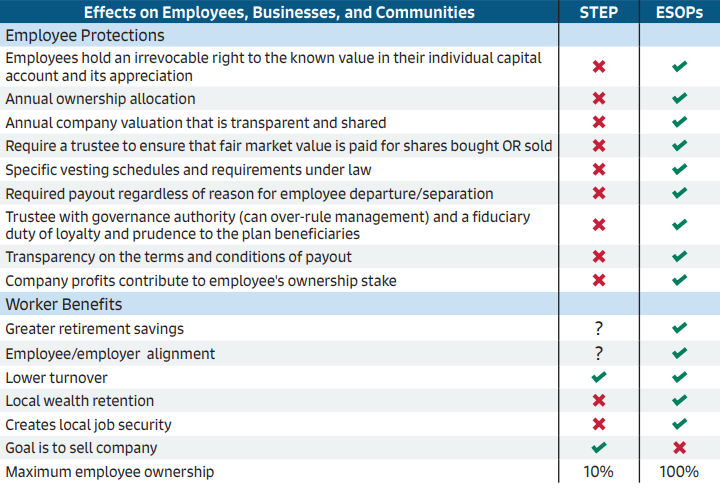

Expanding ESOPs STEP proposal does not provide the same worker protections and long-term benefits as real ESOPs regulated under ERISA.

Sources [1] https://assets-tea.s3.us-east-2.amazonaws.com/assets/public/2025-03/10%20Best%20Things%20About%20ESOPs_The%20ESOP%20Association.pdf [2] https://assets-tea.s3.us-east-2.amazonaws.com/assets/public/2025-03/10%20Best%20Things%20About%20ESOPs_The%20ESOP%20Association.pdf [3] https://assets-tea.s3.us-east-2.amazonaws.com/assets/public/2025-03/10%20Best%20Things%20About%20ESOPs_The%20ESOP%20Association.pdf [4] https://www.aspeninstitute.org/wp-content/uploads/2025/05/Employee-Ownership-and-ESOPs-%E2%80%94-What-We-Know-from-Recent-Research.pdf